4 min read

Welcome to Part 1 of our series What To Do About Bad-Paying Customers! Over the coming weeks we’ll be exploring from top-to-bottom what you can do about your bad-paying customers - from identifying who’s good and who’s bad, through to transforming bad-payers into good ones. Sign up at the bottom of this post so you don’t miss out on the rest of the series - it’ll be sent right to your inbox!

Now that the introductions are out of the way and we’re old friends, I’d like to ask you a question friend-to-friend - which of your customers do you consider ‘good’ and which do you consider ‘bad’?

Why?

It sounds like a basic question, perhaps even a little silly, but it’s easy for this to be an unconscious, emotional decision, potentially based on outlying data. Without taking a step back and analysing which of your customers are actually good and actually bad, you leave yourself open to the risk of poor credit control chasing and weak customer relationship management, from miscategorising them. These risks can stifle your cashflow.

So what actually makes customers ‘good’ or ‘bad’?

In deciding whether a customer is good or bad, there are two main factors to consider:

- How often they pay their invoices on time

- Their credit-worthiness

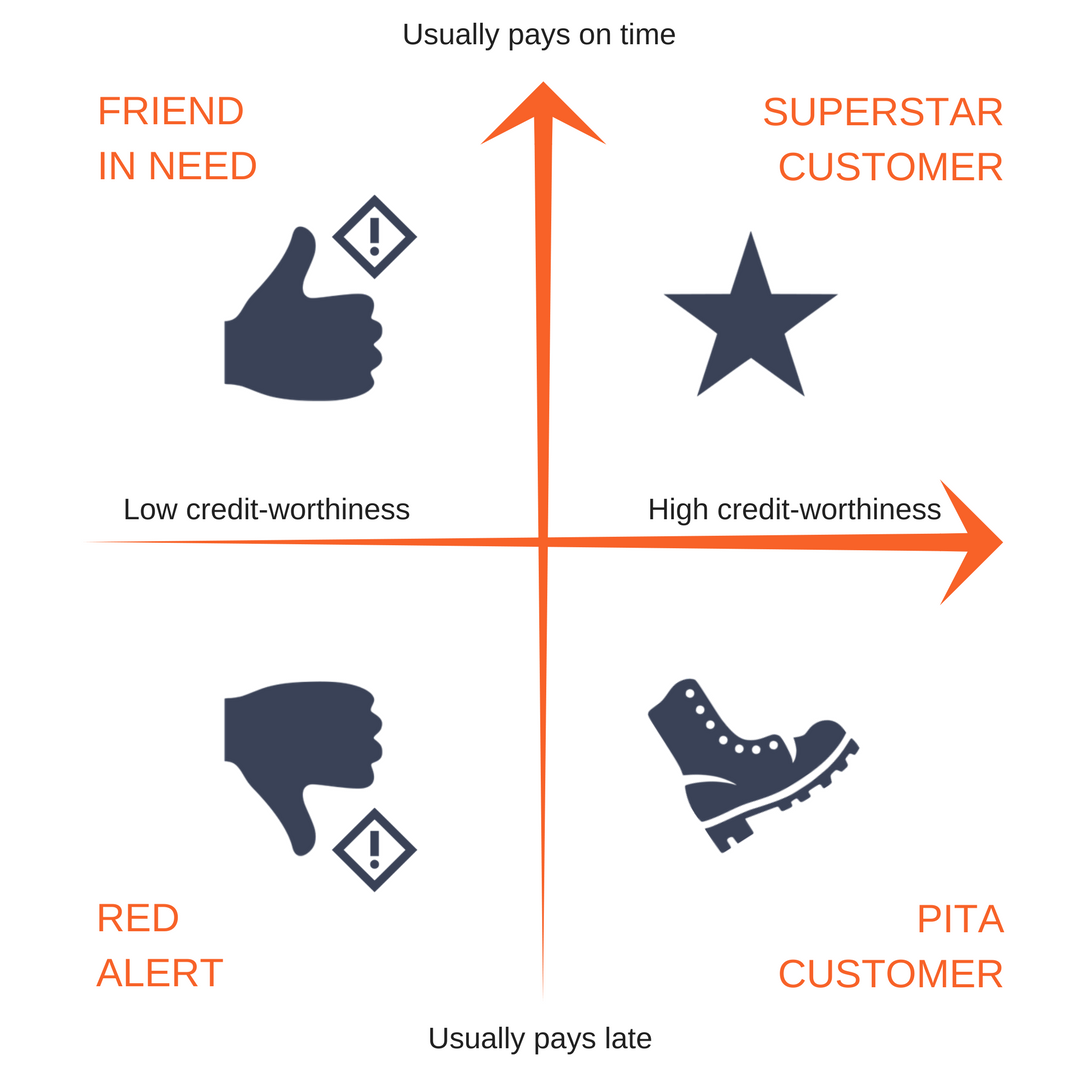

If we use these factors as axes, we can make the following quadrant:

Your Superstar Customers are resoundingly ‘good’ customers. On the numbers front, they usually pay their invoices on time and they have a high credit-worthiness. Typically, you might also see they’re quite responsive to chasers and there is an element of inter-business friendship between their organisation and yours.

Friends In Need are ‘bad’ customers, but unfortunately so. While you may get good intentions, great responsiveness, and potentially elements of inter-business friendship with these customers, they have a poor credit-worthiness and undoubtedly pose a solvency risk. Be aware of getting trapped seeing your customers through rose-tinted glasses - every Friend In Need was a Superstar Customer once. Stepping away from the anecdotal past and regularly assessing your customers’ past payment trends will allow you proactively mitigate any solvency risks they pose.

Next up, PITA Customers. What’s a PITA customer, you ask? Well, I’m not talking about my favourite soft, slightly leavened wheat flour flatbread originating from Mesopotamia, that’s for sure. PITA customers are Pain In The A**e customers - those customers who inevitably pay late almost every. single. time. While they are a ‘bad’ customer, they won’t pose you a solvency risk. Rather, you’ll typically find they are unresponsive to chasers and/or don’t do what they say they’ll do. If you’ve ever found yourself rolling your eyes and thinking “here we go again,” that’s when you know you’ve got yourself a PITA customer.

Finally, Red Alerts are resoundingly ‘bad’ customers, who not only pose a solvency risk with increasingly late payment trends, but also typically may not have the best intentions, are largely unresponsive to chasers, and likely don’t share any elements of inter-business friendship with your organisation. Similarly with keeping aware of Superstar Customers slipping to Friends In Need, you’ll want to be wary of any PITA Customers turning into Red Alerts - something regular, effective credit control meetings are key for.

Know your customers

A core component of amazing credit control will always be know thy customer - you should be able to identify which of the four quadrants your customers fall into.

Be ready to see that a minority of your customers will be Friends In Need and Red Alerts - these can be dangerous customers to have, considering the slippery slope of insolvency risk, but being able to identify this gives you the power to mitigate that risk. You may want to reassess whether you should continue to sell on payment terms to them.

The majority of your customers, however, should be falling into the Superstar Customer and PITA Customer quadrants - those customers who you know will pay their invoices (although some of them will take time and effort...).

With all of your customer types identified, you can most effectively and efficiently tailor your chasing to best manage your customer relationships, reduce your debtor days, and boost your cashflow.

Up next...

Over the coming weeks we’ll be continuing our journey of exploring What To Do About Bad-Paying Customers. In our next post, we tackle the subject of when to escalate your chasing.

Sign up below so you don’t miss out on essential content to improve your finance function.